Less competition is always better, right? Well, not necessarily. We know that might sound a little surprising coming from the self-proclaimed dental market experts, so allow us to explain. First, yes, the ratio of residents per dental office, which is also known as an area's saturation level, is absolutely an important piece of data. BUT there are a lot of subtleties surrounding how to read that number and how it was calculated in the first place.

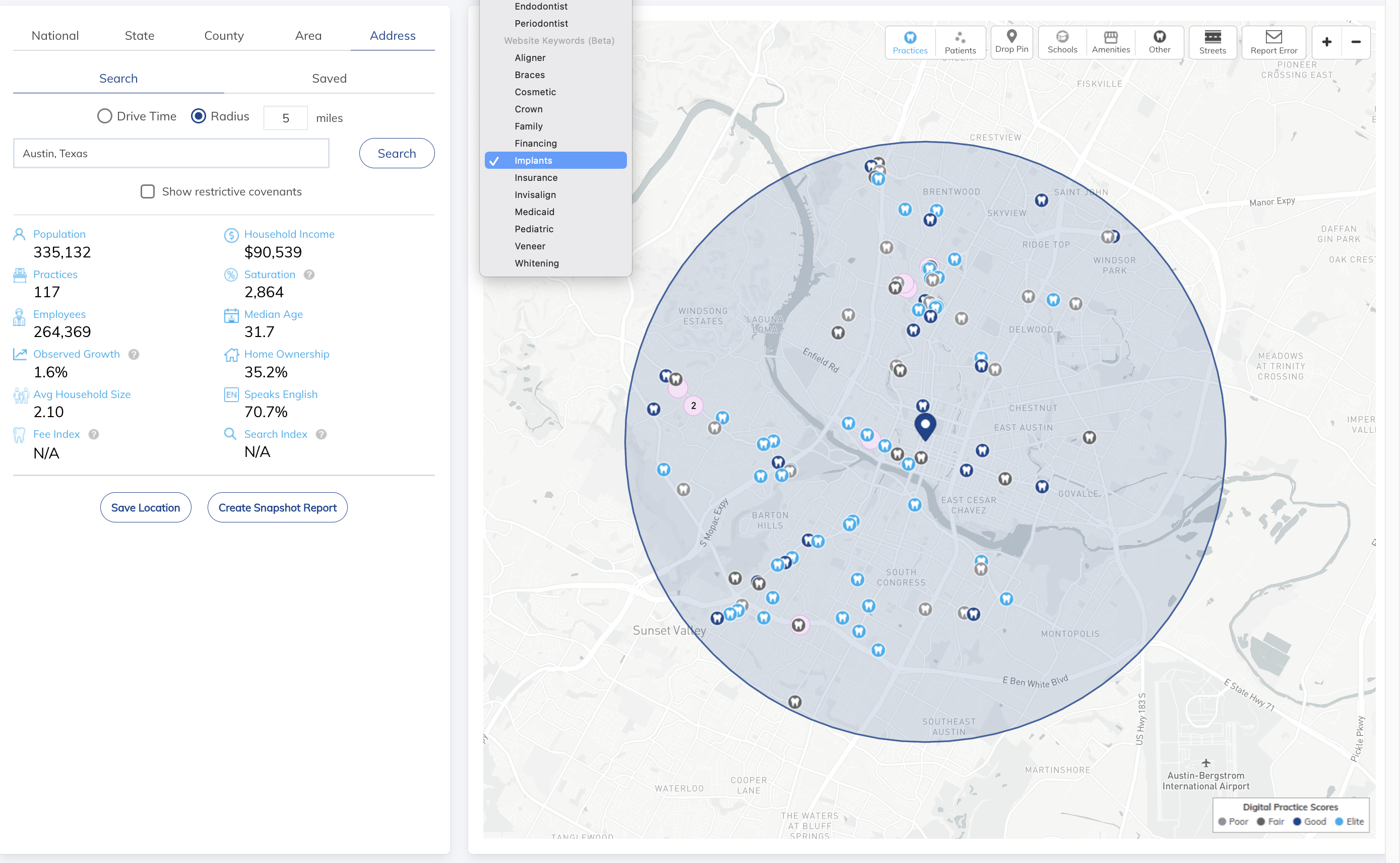

Many readers may have heard the number 2,000 to 1 as a saturation target, But what area, or scale of analysis, should you look at? Should you study your city, or is your zip code a better area to consider? How about a three mile radius around your practice location or a ten minute drive time. The answer is that you should study each of these areas and select the scale of analysis that takes into consideration the location of the competition, the existence of physical barriers and the area’s customs and psychological considerations.

Scale of analysis

Unless you plan on practicing on a small island, there won’t be one perfect scale where you can define EXACTLY who your patient base and competition are. That means that most practices cannot point to one number as their market’s definitive saturation level. Rather, there’s always a degree of uncertainty about who would find your location convenient and which other practices in the area they might consider. For that reason, we recommend looking at multiple scales of analysis, including differing radii around a location, differing drive times from location, and the county, city or zip codes of the location.

In major urban areas, driving even two or three miles might be too much to ask of your “typical” patient. Yes, there may be outliers who come from far away but they are the exception rather than rule. In rural settings, driving more than two or three miles is a part of everyday life and a lot of your patients are likely to come from even farther away. But density isn’t the only factor to consider. Perhaps, for instance, the presence of a river or large roadway means that it’s much easier to travel in one direction than another.

The primary goal when selecting the area to study is that it, as best as possible, is an accurate reflection of your patient base and the competition within it. In some cases, the most accurate portrayal may be a small radius around the site, in others it may be a large drive time or even an entire county. Below are a few examples highlighting potential challenges in reading an area’s level of competition.

Scenario: Competition Nearby

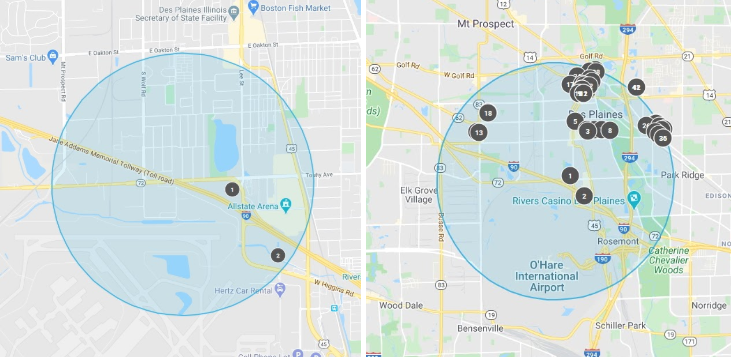

Above: Competition inside of a one mile radii (left) and three mile radii (right) for a site near Chicago’s O’Hare International Airport. Including a start-up, the ratio of residents per general dental office inside of a one mile radius is about 2,500 to 1, which is generally good. But the three mile scale reports about 1,600 residents per practice, which is low. Because the one mile radius is such a small sample size, the three mile scale is probably a better picture of this market.

Scenario: Physical Barriers

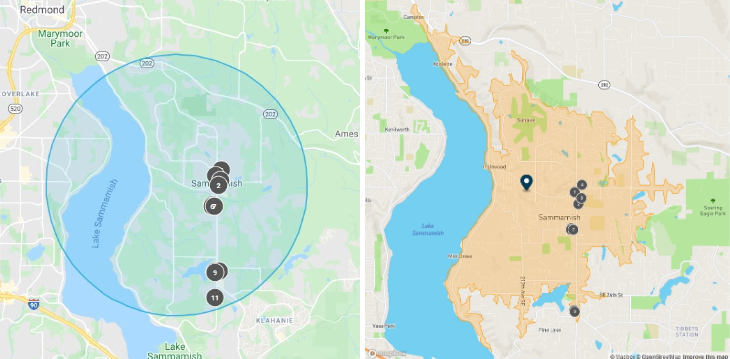

Above: A three mile radius in Sammamish, WA (left) contains about 5,000 residents per dental office, and they have a median household income of over $150,000. However, the three mile radii covers residents who live on the other side of Lake Sammamish must drive a great distance to get around the lake. A study area defined by a ten minute drive time, though, is home to a ratio of 2,800 to 1. While radii analysis shows nearly twice the number of residents per dentist as the drive time analysis, the drive time analysis is probably a more accurate measure.

Scenario: Cultural and Psychological Barriers

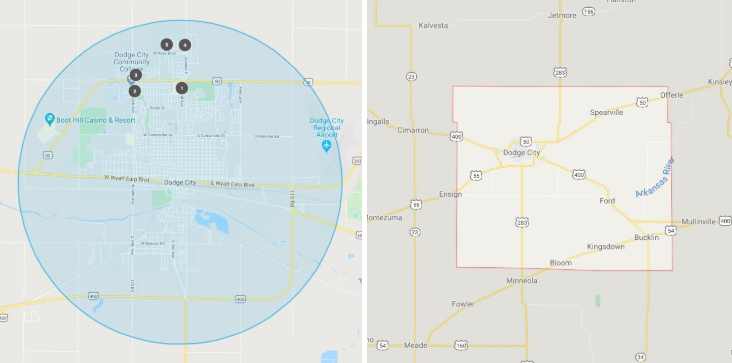

Above: In some cases, neither a radius around a site nor drive time will accurately predict how far people will travel to a dentist. . Particularly in rural areas, people think in terms of counties. In the above example, a three mile radius (left) around the site reports about 4,500 residents per dental office. While that is a good saturation ratio, the region’s rural character allows for, and even normalizes, long distance travel. As a result, we thought it worthwhile to look at Ford County as a whole. Our hunch paid off. Ford County, [State], is home to over 6,000 residents per general dental office!

Scenario: Strong Accessibility to Commercial Areas

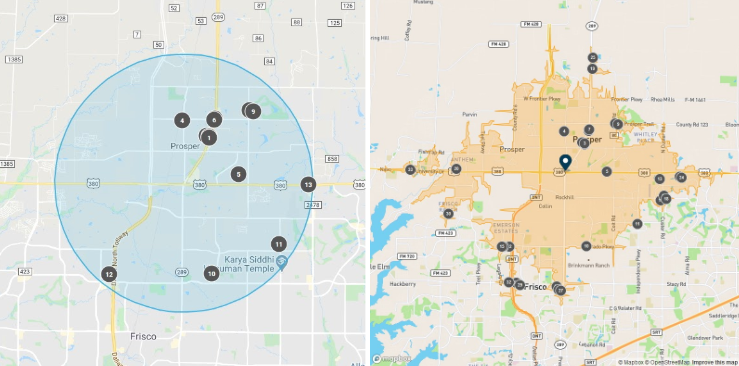

Above: Drive times are usually better than radii for assessing a market’s geographic footprint. But not always, as this sample location in Prosper, Texas demonstrates. Note that it is close to regional roadways and their abutting commercial areas. Using a ten minute drive time, the saturation ratio is only about 1,250 to 1. Note, though, how many of the competing practices on the right are at the very edges of the drive time and how their adjacent residential areas (where the patients live) are not included. Now compare that to the area on the left, which uses a four mile radius. It shows about 3,000 residents per dental office. Since competing practices in the four mile radii are located throughout the study area instead of at its edges, a radii study provides better insight. This situation occurs most often in highly automobile-dependent regions, mostly found in the South and Southeast.

Saturation in Context

OK, so now that you have determined which scales and methodology or methodologies are appropriate for your site, you’ve run the numbers and got some numbers back. But how to interpret them? Does a ratio of 2,000 residents per dental office in a high income market mean the same thing as in a low income area? Here are the primary market conditions to consider:

- Character of Competition: Who are the competing practices, well-run sole practitioner offices and groups that are likely direct competitors? Are they DSOs with big marketing budgets and economies of scale but low patient satisfaction? Or maybe they are smaller offices owned mostly by doctors approaching retirement and making minimal investments in growing their practices. Depending on WHO the competing practices are, the way that you should view the level of competition may vary greatly.

- Demand for Dental Care: Markets offering stronger per capita demand for dental care can tolerate larger supplies of dental offices. Note that this is particularly true for certain specialties like orthodontics but is less influential in pediatric dentistry. Factors to consider when assessing per capita demand for care include income, educational attainment (higher isn’t always better), age and average household size.

- Population Density: How many potential patients live in the market? Smaller population centers, while generally less competitive, do come with a higher risk of change. What if one new practice opens in a town of only 10,000 people? The effect would be felt much more strongly than in an area of 100,000 residents. Similarly, small towns are more likely to rely on a small number of economic drivers. If that town’s major employer closes down, relocates or even just has a bad year, the level of opportunity for a dental practice could plunge quickly.

- Target Patient Base: If the residents of a particular area are not a match with your practice strategy, does the level of competition even matter? Note that the “typical” resident of a market doesn’t always need to be a perfect match with your practice strategy. The goal is that there is a sufficient supply of potential patients, even if they are a relatively niche segment of the market.

Real Estate Considerations

As any commercial real estate agent will be quick to point out, market conditions are only one piece of the site selection puzzle. And keep in mind, site selection is just one factor in the overall success of a dental practice. Should you choose a property based only on market conditions? Of course not. The other half of the equation at this step in the search process is property-specific. How is the visibility? What does the space cost? Will you have sufficient parking? Don’t blindly go to an A-rated market if you’ll get an F-rated property. Maybe a B-rated market near you offers an A-rated property.

Start-up vs Acquisition

Lastly, there is one important distinction to make. If you’re in the market for a start-up, there are three primary components of your search process. For buyers, that list expands to four factors.

- Personal - Where do you want to live, how far are you willing to drive for 10+ years, etc

- Market Conditions - Demographics and competition

- Real Estate Considerations - Visibility, accessibility, parking, signage, price, etc.

- Performance of existing practice - Profit and loss, pricing of the , services and vision (Acquisition only)

Particularly for those that are set on buying as opposed to starting up, that means that the area’s ratio of residents per dental office will play a smaller role in the decision making process. Remember that the best predictor of a practice’s performance immediately after an acquisition is its current state. Especially when the transition process is smooth, market conditions are more relevant for assessing growth potential than what your first week might look like. Of course if you’re purchasing a practice that requires lots of growth, you’ll want to see strong opportunity in the market.

Takeaways

The level of competition in your market, especially when compared to similar communities, is absolutely an important component of your search process. But it shouldn’t be the ONLY thing that you look at, either. Further, there won’t be just one number to point at that is a definitive encapsulation of your market. Before you move forward, make sure you understand how the number is calculated and what any limitations of that model may be.

.png)